Top 10 KYC Providers in 2024

Security concerns are an important aspect of running a business. Without Know Your Customer (KYC) procedures, a company’s reputation and credibility in any sector disappear. Verifying a customer’s identity as part of KYC ensures they legally comply with regulations. KYC processes, which were first widely used in the financial industry, are now essential for sectors including gaming, alcohol, travel, and tourism.

Top KYC service providers are necessary for these industries to avoid fraud and expedite customer onboarding. Businesses hoping to protect everyone from possible threats must understand what KYC means and its importance. In this article, we will help you grasp the procedure’s significance and guide you in choosing some of the best providers.

Key Takeaways

- In many different businesses, KYC procedures are crucial for maintaining client satisfaction, preventing fraud, and following regulations.

- Modern KYC technologies improve security and accuracy, such as facial recognition and biometric authentication.

- Selecting the best provider necessitates assessing business requirements, investigating potential suppliers, and considering scalability.

- Reliable KYC protocols are essential for maintaining regulatory compliance, reducing fraud, and stabilising the market.

How KYC Solutions Work

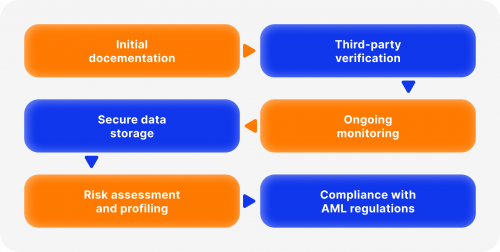

KYC providers confirm customer identities to maintain compliance and prevent crimes. They are essential to client onboarding since they verify that people are who they say they are. Identification verification is crucial to stopping money laundering and other prohibited actions. Customers submit identification documents as part of the verification process, and they are then cross-referenced with multiple databases to verify validity and look for any indications of fraud.

Why Should KYC Solution Be Implemented?

Compared to manual procedures, KYC verification technology streamlines the identification process and improves speed and accuracy. This technology ensures that transactions can be linked to confirmed identities, which helps financial institutions and other organisations fight money laundering.

Additionally, it stops fraud by shielding clients and companies from financial scams. Robust KYC systems include data security features to protect client information and guarantee legal compliance. KYC solutions guarantee that services are only accessible to authorised clients by blocking unauthorised third-party access.

KYC providers use cutting-edge technologies like facial recognition and biometric authentication to enhance security and accuracy. These technologies guard against financial crimes and identity theft by ensuring a safe identification verification process.

To protect the security and integrity of data, KYC procedures entail several compliance checks and continuous monitoring. This all-inclusive strategy guarantees that companies follow legal requirements and protect client identities by including risk assessment, transaction monitoring, and document and biometric verifications.

Not only does it provide KYC easy integration and scalability, but it also easily interfaces with current systems to enhance security. They offer safe identity verification solutions that meet the demands of many industries and have global coverage. By working with an approved KYC service provider, businesses may guarantee a reliable verification system supporting customer onboarding and regulatory compliance processes.

In general, money laundering prevention, client data protection, and the integrity of financial transactions all depend on KYC technology. Businesses may implement sophisticated verification procedures to guard against identity theft and financial crimes for themselves and their clients.

How to Choose the Right KYC Provider

Before choosing a KYC supplier, companies must determine the specific solutions they need. This entails knowing the specifics of their online or on-site customer verification needs. It is critical to consider the requirement for advanced functions like liveness detection and biometric authentication. These features improve security by verifying that the submitted identity is authentic and matches the biometric data supplied.

Companies should evaluate their requirements for adhering to anti-money laundering laws. This includes being aware of the extent to which continuous monitoring procedures and customer due diligence (CDD) are necessary for their business operations. Effective KYC solutions must protect consumer data and provide robust security measures.

Maintaining compliance and protecting consumer identities requires ensuring the selected vendor has secure identity verification solutions and interfaces quickly with existing systems.

Research and Evaluation

Following the definition of the precise needs, companies ought to assemble a roster of possible KYC suppliers. You can compile this list by looking into and evaluating the products and services offered by leading KYC solution providers. Examining these suppliers’ feature sets, holding demonstrations, and taking advantage of free trials are all part of assessing how well their offerings satisfy the company’s demands. Evaluating the suppliers’ skills in fraud prevention, biometric verification, and document verification is critical.

Future adaptability and scalability are crucial components of this assessment procedure. Companies ought to pick a supplier who can expand to meet their needs and change to comply with new laws. Long-term success depends on the provider’s capacity to manage massive amounts of customer data and conduct thorough verification procedures.

Businesses should also examine suppliers’ track records regarding compliance solutions and their capacity to provide continuous risk management and monitoring. This entails confirming that the supplier has a robust system for the customer identification program (CIP), transaction monitoring, and protecting client data from financial crimes and identity theft.

By carefully weighing these factors, businesses can choose a KYC provider that offers a strong verification system, complies with regulations, and guarantees enhanced security for customer onboarding and verification procedures.

Key Features to Look for in KYC Software

Every KYC verification service provider has a distinct characteristic that makes them stand out. Below, we will try to point out several important aspects before we list the actual providers.

Compliance with KYC Regulations

KYC software needs to follow all relevant laws and regulations. It guarantees that companies, from crypto institutions to gaming and tourism, adhere to regulatory requirements in many areas. Maintaining compliance preserves the integrity of consumer verification procedures and helps avoid legal repercussions.

Both High-Speed Verification and Scalability

Scalable KYC solutions are necessary to support corporate expansion. The software needs to manage higher verification volumes effectively as customer bases grow. Rapid verification procedures are essential for ensuring client satisfaction since they facilitate speedy onboarding and shorten wait times. Scalability guarantees that the KYC procedure will remain reliable and effective as business demands change.

User Experience, Data Quality, and Accuracy

Good data quality and accuracy are necessary for efficient identification verification. The program should follow high data accuracy criteria to lower the possibility of identity fraud and provide trustworthy customer verification. A user-friendly interface is also required to make the KYC process simple for customers and company owners.

Options for Integration and Support

Software for KYC should be easily integrated with current systems. This interconnection guarantees seamless operations by avoiding interruptions to corporate processes. Strong vendor support is also essential, helping with installation, troubleshooting, and ongoing upkeep. Dependable assistance ensures the KYC system functions well and adjusts to required modifications.

Improved Data Security and Safety

To protect client data, KYC software must have security features. Strong security measures guarantee that private data is protected and stop unwanted access. This covers adhering to data protection laws, using secure storage methods, and encrypting data.

Innovative Technologies for Verification

Advanced verification technologies like facial recognition and biometric verification should be part of modern KYC systems. These methods improve the verification process’s security and accuracy. Using biometrics, identity documents are validated to confirm the presence of the person being confirmed.

Entire Reporting and Observation

In effect, KYC software should provide extensive reporting and monitoring features. This includes tools for continuing compliance monitoring, thorough reports on verification results, and real-time monitoring of verification procedures. These capabilities support companies in upholding compliance and promptly resolving any problems that may emerge.

Adaptability and Personalisation

KYC software offers businesses flexibility and the choice to customise solutions to meet their unique requirements. This entails establishing risk assessment parameters, putting up verification procedures, and adjusting to particular business needs. Customisable solutions guarantee that the KYC procedure complies with legal and corporate criteria.

Concentrating on these essential qualities may help businesses select a provider that delivers robust KYC processes, guarantees compliance with KYC and AML standards, and offers a safe, effective, and user-friendly verification process.

Fast Fact

KYC laws were put in place to deal with financial crimes. The United States Bank Secrecy Act, which addressed money laundering, set the groundwork in 1970. After the terrorist attacks of September 11, 2001, and the global financial crisis of 2008, there were significant modifications.

Top 10 KYC Providers in 2024

Choosing the top-rated KYC provider is up to you. However, we will help you see the broader picture and give you some of the best KYC solution providers today.

1. Microblink

Microblink is well-known for its AI-driven identity verification solutions, which lead the industry in accuracy, speed, and fraud prevention. Their highly configurable solutions support Flutter SDKs and APIs for smooth integration as well as Android and iOS SDKs.

One of their main features is their capacity to process massive amounts of paper quickly, which makes them perfect for companies needing effective KYC procedures. Furthermore, Microblink offers enterprises high security and compliance thanks to its powerful fraud detection capabilities.

2. Shufti Pro

Shufti Pro has a broad reach, offering ID verification services in over 200 nations. Their products stand out for their accuracy, particularly when scanning large amounts of documents, and their capacity to stop duplicate accounts, which improves business security. Moreover, Shufti Pro provides sophisticated AML compliance tools to guarantee that companies adhere to legal obligations.

3. Seon

Seon is an expert in offering complete risk management solutions that address AML, fraud prevention, and KYC. Their primary focus is e-commerce and online enterprises, providing unique features that guard against fraud. Seon is a beneficial partner for organisations seeking to preserve their reputation and clientele, as their products are engineered to improve security and compliance for enterprises functioning in the online arena.

4. Ondato

Ondato offers various services, such as transaction monitoring, KYC, and KYB. It is a robust KYC AML service provider with instruments preventing money laundering. Because of its many features and advantages, Ondato is a dependable option for identity verification, improving businesses’ security and compliance.

5. KYC-Chain

KYC-Chain offers tools to stop money laundering through cryptocurrency transactions and solutions for traditional and blockchain-based AML. They provide enterprises with an all-inclusive identity verification solution emphasising integration and distinctive features. KYC-Chain is a dependable option for identity verification since its services are made to improve security and compliance for companies that operate online.

6. Sumsub

Sumsub provides solutions, including high-speed KYC, KYB, transaction monitoring, and fraud prevention to various industries, including financial technology, cryptocurrency, and transportation. Their services are well-liked by companies trying to simplify their verification procedures because of their scalability and ease of integration. Sumsub stands apart in the identity verification market thanks to its emphasis on offering complete and practical solutions.

7. Trulioo

Leading the way in identity verification worldwide, Trulioo uses 450 data sources and covers more than 190 nations. Their solutions are all-inclusive, providing rigorous watchlist checks and biometric verification for AML protection. Trulioo is an adaptable option for companies with various verification needs because it serves multiple sectors and use cases.

8. Onfido

Digital identity solutions from Onfido include passive fraud detection and document verification. Their products are designed with online and e-commerce enterprises in mind, emphasising user experience and integration capabilities. Onfido’s services are intended to give companies dependable and effective identity verification, improving security and compliance.

9. Refinitiv

Refinitiv is a reliable source of financial market data, providing solutions for account, ID, and KYC verification. Their services, which offer essential features targeted at particular industries, are made to assist organisations with due diligence and onboarding procedures. Refinitiv is a beneficial partner for firms that want safe identity verification because of its well-known accuracy and dependability in solutions.

10. Fractal ID

With KYC services explicitly designed for decentralised applications and blockchain ecosystems, Fractal ID specialises in providing services to Web3 firms. They offer identity verification solutions tailored to the specific requirements of investors, venture capitalists, and accelerators. Fractal ID’s ability to provide trustworthy and safe identity verification for decentralised systems makes it unique in the market.

Should the Crypto Industry Implement KYC?

In the cryptocurrency sector, regulatory compliance is now crucial. Authorities have particular difficulties guaranteeing security and transparency because cryptocurrencies are decentralised and frequently anonymous. Strong KYC policies must be implemented if the crypto market is to be stabilised and given legitimacy.

Resolving Security Issues

Notable security lapses have characterised the history of cryptocurrencies, like the 2011 Mt. Gox hack, which cost roughly 647,000 Bitcoins. Large exchanges like FTX and Binance have recently encountered legal issues due to inadequate adherence to KYC and AML protocols. These occurrences show how important it is to have strict security measures to safeguard users and preserve consumer trust in the market.

Preventing Money Laundering and Fraud

The purpose of KYC and AML procedures is to stop illicit activities, including fraud, money laundering, and financing of terrorism. Coin exchanges can drastically lower the risk of illegal activity by confirming users’ identities and monitoring transactions. For example, the legal actions that BitMEX faced in 2020 highlighted the significance of compliance, as the exchange was subject to harsh penalties for its failure to establish appropriate KYC protocols.

Improving the Stability of the Market

Putting KYC policies in place helps stabilise the erratic cryptocurrency market by boosting investor confidence. Clear and strictly enforced regulations can draw in institutional investors and create a safer environment for all parties. Improved identity verification procedures help create a more transparent and reliable market by discouraging fraudulent activity.

Finding a Balance Between Innovation and Regulation

Businesses that deal with cryptocurrencies must balance technological advancement with regulatory requirements. The requirement for compliance and the decentralised nature of cryptocurrencies frequently clash, necessitating creative solutions to resolve these issues. The Financial Action Task Force (FATF) advises businesses to take a risk-based approach to compliance, which enables them to effectively deploy resources and customise their AML/CFT procedures according to the estimated risk of specific clients.

International Cooperation and Standards

Global standards for KYC and AML procedures are becoming increasingly important as the crypto sector develops. Ensuring complete compliance and addressing the international nature of cryptocurrencies require uniform regulatory frameworks. To promote a healthy digital asset ecosystem, cooperation between users, businesses that deal in cryptocurrencies, and regulatory agencies is crucial.

Benefits of Implementing KYC

To sum up the importance of KYC, let’s now conclude with several advantages it brings to the table:

- Legal Compliance: By following KYC laws, cryptocurrency exchanges can avoid fines and avoid trouble with the law.

- Client Trust: By displaying a dedication to security and transparency, robust KYC procedures increase client trust.

- Market Stability: By lowering the risk of fraud and illegal activity, robust KYC procedures support market stability.

- Operational Efficiency: Good KYC practices enable businesses to handle compliance effectively and offer a satisfying user experience.

Last Remarks

After reviewing all the necessary details and information, it’s evident that robust KYC solutions are required for fraud protection, customer happiness, and compliance. Evaluating business goals, exploring possibilities, and considering future scalability are critical factors in choosing the best KYC provider. Pick a supplier who meets your needs and guarantees a safe and legal operating environment.

FAQs

How should I pick a KYC supplier?

Determine the features your provider offers, assess your company’s needs, and make sure security and compliance are provided.

Is KYC applicable globally?

KYC is mandated in many nations to ensure regulatory compliance and avoid financial crimes.

Who needs KYC?

KYC is required for financial institutions, enterprises operating in regulated industries, and businesses handling large transactions.